Facing bankruptcy can bring about many emotions, including embarrassment, shame, and feeling like a failure. However, financial hardship doesn’t mean an individual is irresponsible or is recklessly living beyond their means. It can be caused by events or situations outside of their control, such as sudden job loss, the loss of a spouse, an accident or injury, and unexpected medical bills.

In fact, many individuals and businesses have used bankruptcy as the best alternative for resolving a financial crisis. In 2019, the total number of bankruptcy filings in the United States increased slightly from 2018.

If you are in a financial crisis, bankruptcy may be an option for you to alleviate debt and give you the opportunity for a fresh start. In this article, we will explain what bankruptcy is, how it can help, and the different types of bankruptcy in the State of Florida.

What Is Bankruptcy?

Bankruptcy is a legal process in which your debt is “discharged” or reorganized. In other words, bankruptcy may eliminate your legal obligation to pay some or all of your debt. Here are some ways bankruptcy can help:

- It may protect your home from foreclosure or your automobile from being repossessed

- Stop wage garnishment

- Stop collection agencies and creditors from contacting you demanding payments

- Lower debt payments

- Prevent utility services from being terminated

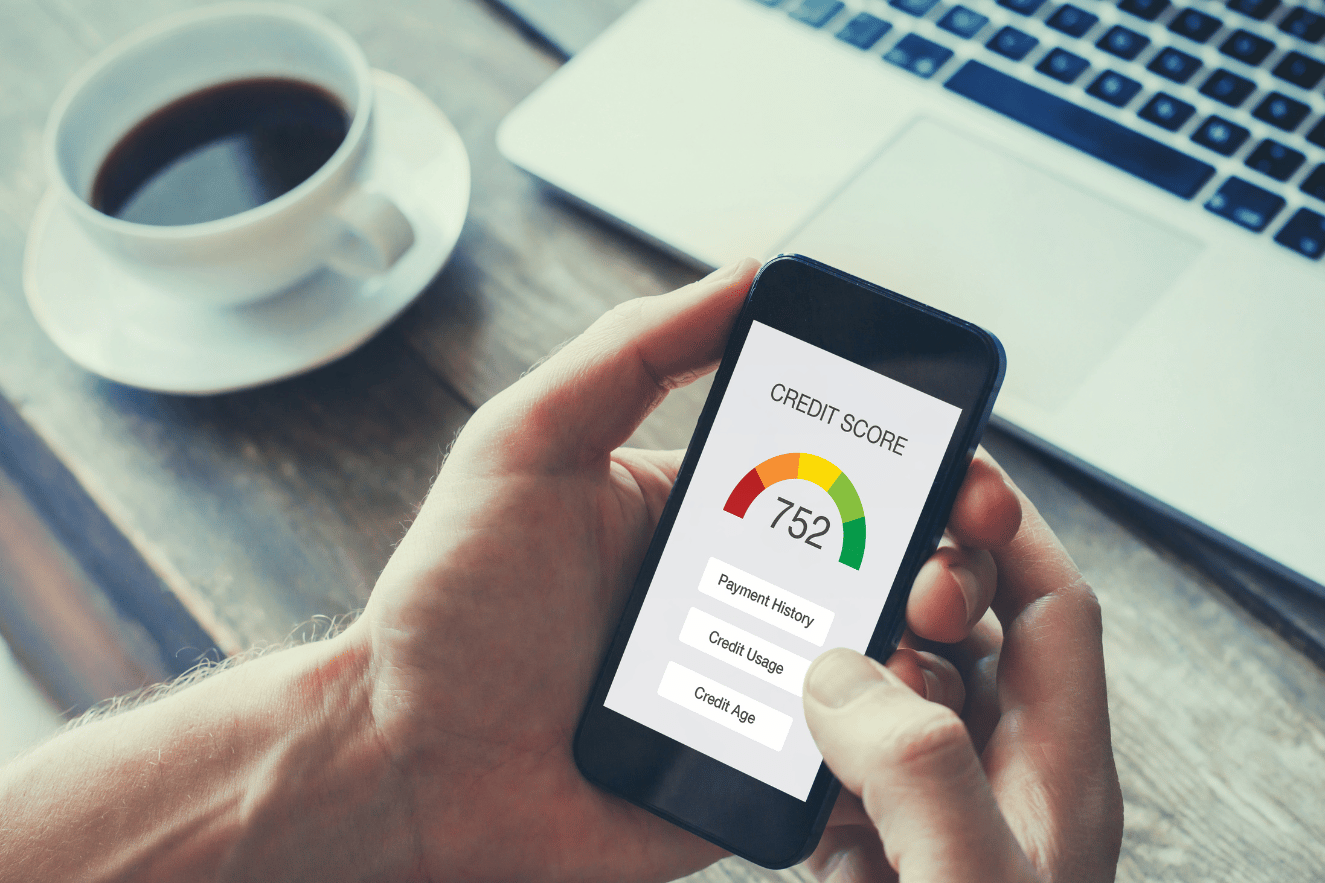

It is important to note that some debts, such as alimony, child support, student loans, and taxes are non-dischargeable. Therefore, it’s always a good idea to speak with a financial advisor or legal professional to understand the implications that filing for bankruptcy may have on your credit report and securing future loans.

Types of Bankruptcy in Florida

Individuals have the option of two different types of bankruptcies in the State of Florida based on their circumstances and qualifications: Chapter 7 and Chapter 13.

Chapter 7 Bankruptcy—Chapter 7 bankruptcy is also known as “liquidation bankruptcy.” With this type of bankruptcy, an individual’s non-exempt assets are evaluated by a trustee and sold off or “liquidated” in order to pay back lenders and creditors. The remaining debt is “discharged” and the individual is released from their obligations to repay.

Chapter 13 Bankruptcy—In a Chapter 13 bankruptcy, an individual will negotiate with lenders and creditors to reduce or alter the terms of the loan or debt without having to resort to liquidation. A repayment plan is established through a trustee for the debtor to repay all or a portion of the debt to creditors within three to five years.

Eligibility Requirements

Although the official Bankruptcy Code is Federal Law, bankruptcy outcomes may vary state-to-state based state exemptions and laws.

In order to file for bankruptcy in the State of Florida, individuals must meet certain requirements and income guidelines. If you have been a resident of Florida for at least two years, then Florida bankruptcy exemptions and laws will most likely apply to your case.

For example, you will likely qualify for Florida Homestead Bankruptcy Exemption Protection, which protects your primary residence—regardless of value—from lenders and creditors. In the event that you have been a Florida resident for less than two years, exemptions from the state where you previously resided may apply to your case.

An individual can immediately qualify for Chapter 7 bankruptcy by showing that their monthly household income is below Florida’s median income for their household size. Another way to qualify for a Chapter 7 bankruptcy is to pass the Means Test, which involves analyzing an individual’s average monthly household income and monthly household expenses, and determining the amount, or lack of, disposable income.

With a Chapter 13 bankruptcy, an individual must have an adequate and stable income in order to satisfy payments in the proposed repayment plan.

An individual may also be required to complete bankruptcy education or credit counseling classes before and after filing for bankruptcy.

The Bankruptcy Process in the State of Florida

Step 1: File a petition with the bankruptcy court. You will likely also need to provide documentation of your monthly household income and expenses, as well as your assets, debts, and liabilities.

Step 2: After the petition is filed with the Court, a hearing or “meeting of creditors” is held to review your case. At this time, your creditors and trustee will have the opportunity to ask you questions and verify information concerning your assets, debts, income, and expenses.

Step 3: In a Chapter 7 bankruptcy case, if the Court has ruled in your favor, the Court will send a “discharge order” to all of your creditors releasing you of your obligations to repay.

In a Chapter 13 bankruptcy case, your debt will not be discharged until all of the requirements of the repayment plan have been met. You are, however, protected from collections, creditors, and potential garnishments during this time as long as you are complying with the terms of the plan.