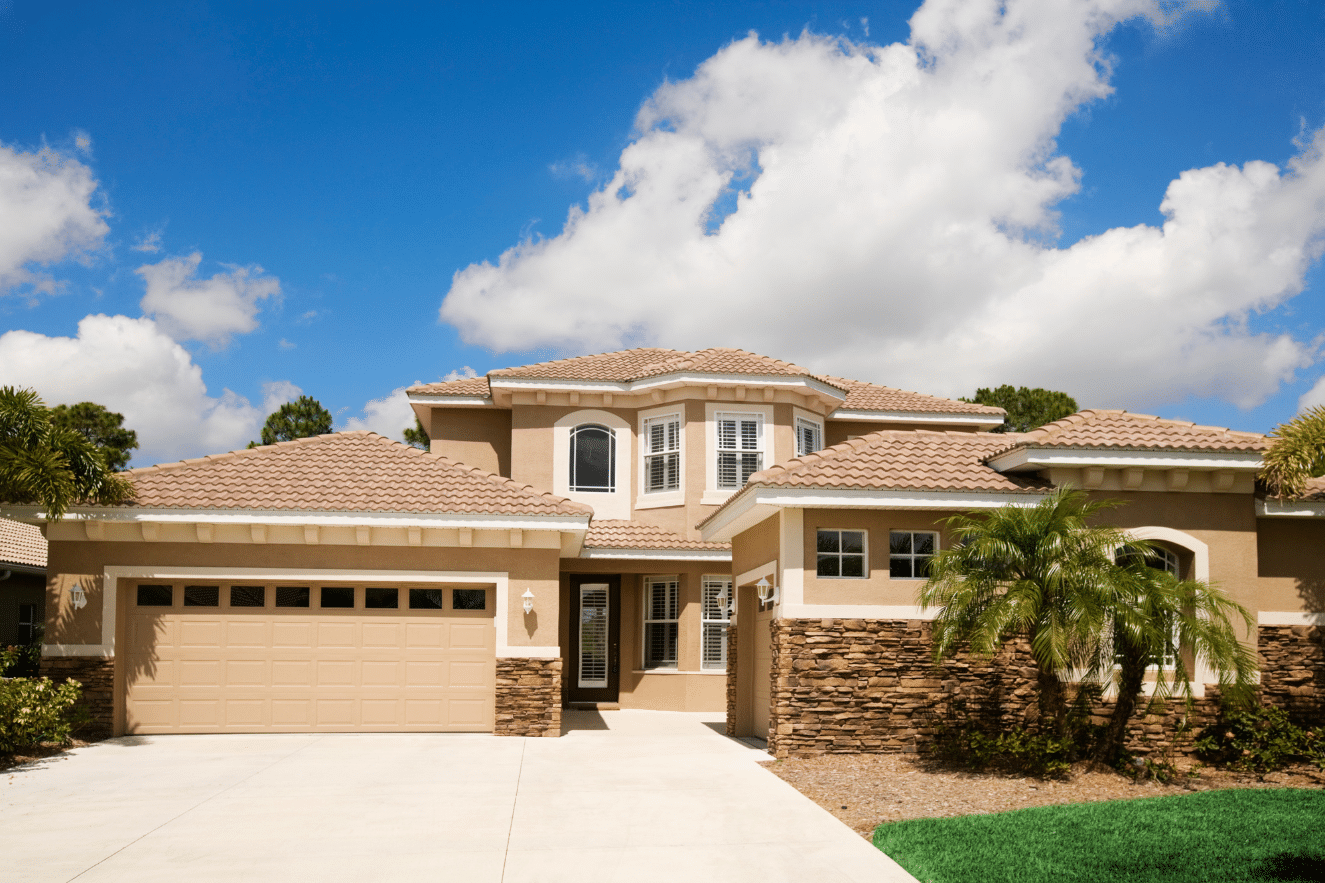

Although foreclosure activity in the United States declined in 2019, it is expected to increase in 2020 due to the COVID-19 pandemic. Homeowners who are dealing with severe financial hardship may have to foreclose on their homes.

Many people do not understand the foreclosure process or what options might be available to avoid losing their homes. In this article, we will explain what a foreclosure is, the foreclosure process in the State of Florida, and the different actions and legal options available that might help you keep your home.

What Is a Foreclosure?

Foreclosure is a legal process in which a lender can take control of a property when an individual is behind on and/or unable to make mortgage payments. In a foreclosure, the lender sells the property in order to recoup the balance owed on the home loan, and the homeowner is evicted from the property.

Foreclosure laws can vary state-to-state and even county-to-county. Florida foreclosure law is very technical. Lenders sometimes do not jump through all of the procedural hoops for a foreclosure proceeding.

In some cases, a foreclosure could be triggered by an administrative error by the lender, where a payment is not processed correctly or the mortgage was incorrectly recorded. If this is the case, it is important to identify and present these mistakes to the lender immediately.

Lenders can take legal actions against delinquent borrowers, however, consumers are protected by the Fair Debt Collection Practices Act. If a lender violates the Act, then they may be required to pay monetary damages to the borrower.

The Florida Foreclosure Process

- Pre-Foreclosure

The Pre-Foreclosure period begins once an individual has become delinquent on one or more mortgage payments. During this time, the lender will mail missed payment notices to the homeowner in an effort to receive payment. Late payment fees will most likely be applied to the loan.

- Foreclosure

If the homeowner has failed to make his or her payment within 120 days, the lender can then take legal action. To initiate the foreclosure proceedings, the lender will send the borrower a notice that the loan is in default and that legal action will be pursued.

Then, the lender will file a complaint with a judicial Court, along with a notice of an impending lawsuit which is referred to as “lis pendens”. The homeowner will be officially served with a summons and will have 20 days to respond. Failure to respond may result in the Court ruling in favor of the lender.

The lender may motion for a “summary judgment” to speed up the foreclosure process. Both parties will have the opportunity to plead their cases and the Court will make a judgment. If a summary judgment is denied by the Court, the foreclosure will go through formal trial proceedings.

- Auction and Eviction

If the Court rules in favor of the lender, then the property will usually go to auction within a few weeks of the ruling. After the property is sold at auction, ownership of the property will transition to the buyer and the previous owner will be evicted from the home. In the event the sale of the property does not cover the full amount owed, lenders have the option to seek a “deficiency judgment.”

What Are Your Options?

If you are unable to make your mortgage payments and are facing a possible foreclosure, here are some actions you can take:

- Negotiate with your lender to reinstate the mortgage and or modify the terms of the loan. It is best to do this during the pre-foreclosure period. A lender is more likely to work with you if you take action sooner than later.

- Defend the foreclosure proceeding. It is recommended to have qualified legal representation to help you understand the foreclosure laws in your area, assist you in navigating the legal system, and help present your case to the Court.

- Sell your property to pay off the loan, such as through a short sale or another method.

- Turn the home over to your lender outright.