Estate Planning Checklist for Florida Residents

Proper estate planning is crucial for individuals of all ages and income levels. With a well-crafted estate plan, you can minimize estate taxes, avoid probate, and choose exactly how you want to distribute your assets. The Law Offices of Travis R. Walker guides you through the estate planning process with this checklist so that you know how to best secure your loved ones’ futures.

Estate planning helps you ensure your loved ones are cared for after your passing. Regardless of your age or income level, estate planning is essential. Well-organized estate plans help you ensure your wishes are followed while minimizing estate taxes and costly probate proceedings to reduce the burden on those you leave behind.

One of the most important aspects of estate planning is ensuring your wishes are legally documented. To establish a legally valid and effective estate plan in Florida, follow our comprehensive estate planning checklist. This checklist includes everything from writing a will to creating a plan so that someone else can make decisions for you if you become incapacitated. Get started today to secure the future of your loved ones by scheduling a consultation with The Law Offices of Travis R. Walker.

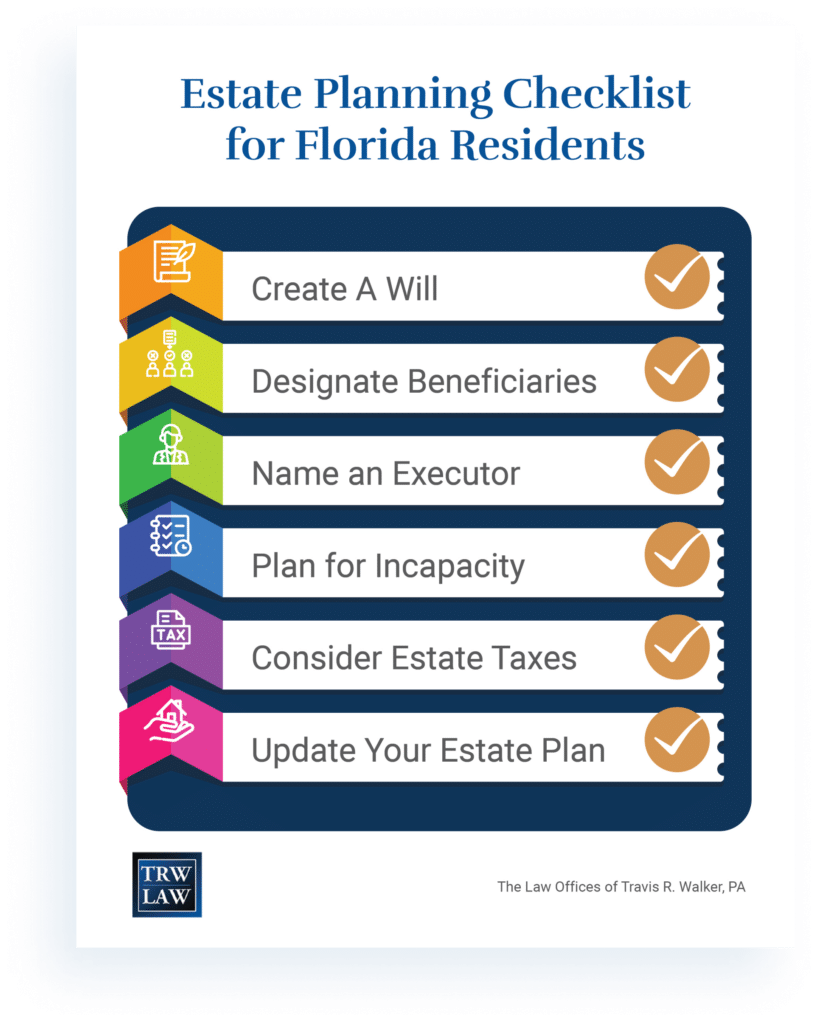

Overview of Estate Planning Checklist for Florida Residents

Estate planning includes the following key elements:

- Create a will

- Consider a trust

- Designate beneficiaries

- Name an executor

- Plan for incapacity

- Consider estate taxes

- Update your estate plan

Estate Planning Checklist

The estate planning process includes many different aspects, and having a checklist helps you stay organized. While this checklist briefly covers the main elements of this process, make sure to also read our 25 steps for estate planning, which is available as a printable estate planning checklist.

Generally, the estate planning process will involve the following:

- Identifying your goals and objectives

- Gathering information about your assets and liabilities

- Considering different estate planning strategies and choosing the ones that align with your goals

- Developing a plan and drafting documents

- Reviewing and revising the plan

- Implementing the plan by signing the necessary documents and taking other required actions

- Regularly reviewing and updating your estate plan to ensure it continues to meet your goals and reflects any changes in your circumstances

Estate planning includes these five vital components, which you can address with the help of an estate attorney:

- Wills and trusts

- Beneficiary designations

- Powers of attorney and health care directives

- Asset protection

- Tax planning

Use this will and estate planning checklist to ensure that you have taken care of all of the essentials.

Create a Will

A will is a legal document that specifies how an individual’s assets will be distributed after death. Without a valid will, Florida state law dictates how assets are distributed. These default rules may not align with your wishes and can lead to a lengthy probate process for beneficiaries.

A will must meet specific requirements to be legally binding in the state of Florida, such as:

- Documented in a written form

- Signed by the individual drafting the will

- Witnessed by at least two individuals and signed by them in the presence of each other and the testator

Failing to follow state law requirements when creating a will is a common estate planning mistake. An experienced estate planning attorney can help you draft and execute a will in compliance with Florida law.

A comprehensive will not only specifies the assets you will bequeath to your beneficiaries and who will receive your assets, but it also stipulates how estate expenses or debts will be paid. An estate planning attorney can determine which payment method—for example, liquid assets, tangible assets, or life insurance—best suits your goals.

Consider a Trust

A trust is a legal arrangement where a trustee manages assets for the benefit of a beneficiary. There are several benefits to using a trust in estate planning, including:

- Avoiding probate proceedings

- Ensuring that assets are distributed according to your wishes

- Minimizing estate taxes

In Florida, you can choose from a wide range of trusts, from special needs to joint trusts. However, the most common types of trusts are the following:

- Revocable, which can be terminated or changed during your lifetime

- Irrevocable, which needs the beneficiaries' consent to make changes

- Charitable, which allows for the donation of assets to specific organizations

After creating the trust document, your attorney will help you properly execute your trust documents so that your trust is valid.

Designate Beneficiaries

If you do not designate beneficiaries in a will, your estate may end up in probate court and be distributed according to default rules provided by state law.

Designating beneficiaries can simplify the probate process because it clarifies who is supposed to receive each asset. Beneficiary designations can also help prevent disputes between potential heirs or beneficiaries because there is less ambiguity about who is supposed to get a particular asset.

Some assets may have pre-designated beneficiaries, such as the following:

- Life insurance policies

- Retirement accounts

- Investment accounts

For these, you must contact the account administrator or policy provider to designate a particular individual as a beneficiary.

An experienced attorney can also help you avoid common estate planning mistakes people make when selecting beneficiaries. For example, some people forget to name contingent beneficiaries. By naming a contingent beneficiary, you can decide who gets your assets if your primary beneficiary predeceases you.

Name an Executor

Naming an executor ensures that someone you trust will be responsible for carrying out your wishes. The executor, also known as a personal representative, will manage the estate by doing the following:

- Ensuring that the instructions in the will are carried out

- Identifying and valuing assets

- Paying debts and taxes

- Distributing the remaining assets to beneficiaries

- Being responsible for managing the estate's property until the distribution is complete

Along with that, the executor in Florida must meet several requirements, including the following:

- Reside in the state or be a close relative of the deceased

- File the will with the probate court within 10 days of the testator's death

- Distribute the remaining assets to the beneficiaries according to the terms of the will

- File all necessary tax returns

- Provide an account of the estate to the court and beneficiaries

Plan for Incapacity

Forgetting to plan for incapacity is another common estate planning mistake an attorney can help you avoid. Planning for incapacity involves making arrangements for when you cannot make decisions due to illness, injury, or mental impairment. Without a plan, your loved ones may have to make crucial decisions on your behalf without knowing your wishes. These plans help with the following:

- Ensuring your wishes for medical care are known

- Preventing conflict and confusion for family members

- Offering peace of mind to loved ones

There are some items to include in your estate planning documents checklist, such as:

Durable Power of Attorney

Authorizes someone to make financial decisions on your behalf.

Health Care Surrogate

Allows an authorized individual to make medical decisions for you.

These documents must be signed, witnessed, and notarized to ensure compliance with state laws.

Consider Estate Taxes

Estate planning involves more than just distributing assets after death. Estate taxes can significantly reduce the value of an estate, which is why planning for these expenses in advance is essential.

While the federal government imposes an estate tax on the value of a person’s estate at the time of their death, there is no state estate tax in Florida. As of 2023, the federal estate tax exemption is $12.06 million, meaning estates valued below this amount are not subject to federal estate tax. However, estates above this amount may face a tax rate of up to 40 percent.

There are several strategies that individuals can use to reduce the impact of estate taxes on their estate. The most common approach is establishing a trust, which can help minimize estate tax liability while providing asset protection and control over distribution.

Another strategy is to make gifts during one’s lifetime, which reduces the value of the estate and estate tax liability. Other strategies include:

- Life insurance planning

- Charitable giving

- Retirement account planning

An experienced estate planning attorney can review your assets and estate plan to determine potential estate tax issues and recommend strategies to minimize tax liability.

Update Your Estate Plan

Reviewing and updating your estate plan is essential. It’s a good idea to check your estate plan at least every three to five years. You should also check and update your plan if you experience significant life changes, such as a marriage or welcoming a new child into your family.

Along with that, you will want to follow other tips to maintain an updated estate plan, including:

- Keeping a detailed list of your assets and updating it regularly

- Updating your powers of attorney if needed

- Communicating with your executor and letting them know where your estate planning documents are located

- Updating your estate plan to reflect changes in your life, such as marriage, divorce, births, or deaths

At The Law Offices of Travis R. Walker, we have decades of combined experience in estate planning, probate, trust administration, and trust litigation. Our dedication is demonstrated through our clients’ testimonials, which show our commitment to providing comprehensive estate planning services. Contact us online or call 772-247-5342 to schedule a consultation with our Florida estate planning team today.