When you run into problems paying your mortgage, it may feel like you do not have any options other than to keep struggling through or turning your property back over to the bank through a forced foreclosure sale. However, you may have more control over your situation than you might think. Florida residents have certain protections and rights even when a bank or other lending institution is getting ready to start the foreclosure process.

In this article, we will go into detail about the differences between a short sale and foreclosure in Florida.

What Is a Foreclosure?

A foreclosure is a legal term for the lawsuit that your lending institution starts so it can seize a mortgaged piece of real property. A foreclosure will only start if the bank thinks that you have breached your lending agreement. The breach is usually caused because the borrower was unable to keep up with their mortgage payments.

In Florida, you have a right to defend your case in Court. Your lender must follow precise notice requirements and stay within a prescribed timeline under Florida law. If the lender does not follow each of these very specific requirements, then you may be able to delay or stop the foreclosure altogether.

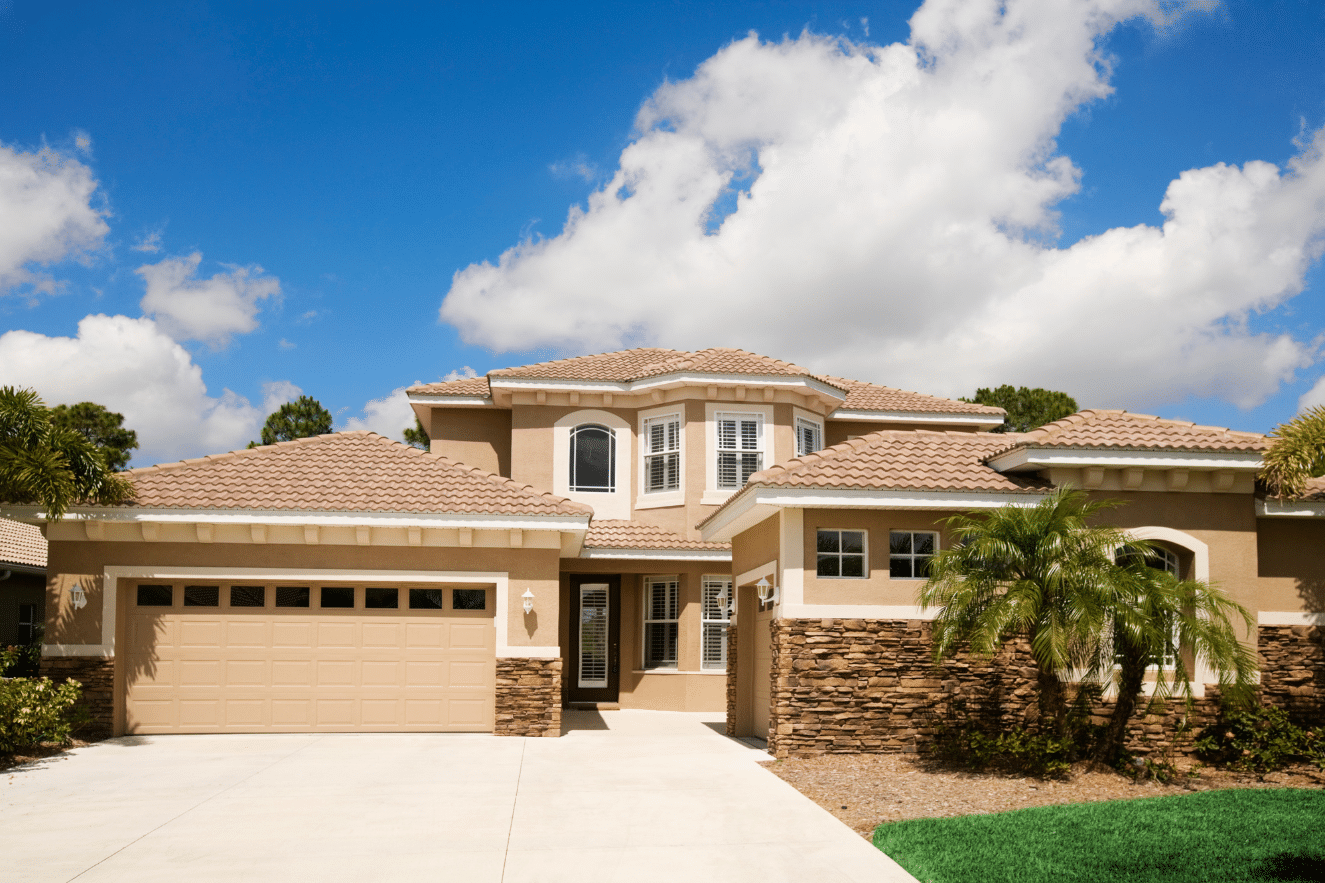

Once the bank forecloses on your home, then they take over the property. Your home will often be sold at a judicial auction to the highest bidder, but not always. The entire process is forced upon you, which is unlike a short sale.

What Is a Short Sale?

On the other hand, a short sale does not use the foreclosure process at all. Instead, the bank will work with you to put the home on the market and sell it. The sale will usually be less than what is owed on the house, which means that the bank comes up “short” when selling it—which is where the process gets its name.

In a short sale, the bank will work with you and a realtor to ensure that it gets as much money as possible out of the sale. The benefit to the homeowner is that you can often negotiate that the money still owed to the bank after the sale (the “deficiency”) is forgiven or written off.

The bank often will not write off the deficiency in a foreclosure, which means you can end up paying a loan for a property that you no longer own. Getting the deficiency forgiven as part of a short sale can be a huge benefit in some situations.

What Is the Difference Between a Short Sale and a Foreclosure in Florida?

One of the most significant differences between these two transactions is that a foreclosure is adversarial, while a short sale is based on mutual benefit and negotiation.

In many cases, a bank will prefer a short sale because it requires less legal work compared to going through the foreclosure process. When all parties agree, the process is significantly less time consuming and expensive. When the bank can avoid attorney fees and expenses related to a foreclosure, they may be more willing to work with you to waive a deficiency through a short sale. Of course, the lower the deficiency, the more likely the bank will agree to a short sale.

Because of all of the protections that Florida law gives residents, the foreclosure process will often take significantly longer than a short sale as well. On average, the foreclosure process will take between eight and 14 months, but it can be even longer if you hire a foreclosure attorney in Florida. In some cases, a bank may be motivated to shorten that time by agreeing to a short sale.

Getting Help from a Foreclosure Attorney in Florida

A lender often realizes that working together will provide the best result for all parties involved. Therefore, they may be willing to arrange a short sale, deed in lieu of foreclosure, or negotiate some other option to avoid foreclosure with you.