While a valid will is an essential component of any estate plan because it allows you to control the distribution of your assets upon your death, it is not a means to avoid probate in Florida. A valid will successfully admitted to probate instructs the court on how to distribute your assets after your death.

Probate is the court process by which your estate is administered, assets are identified, debts are paid, and your property is distributed to your intended beneficiaries. Most assets held solely in your name at death will be subject to probate in Florida.

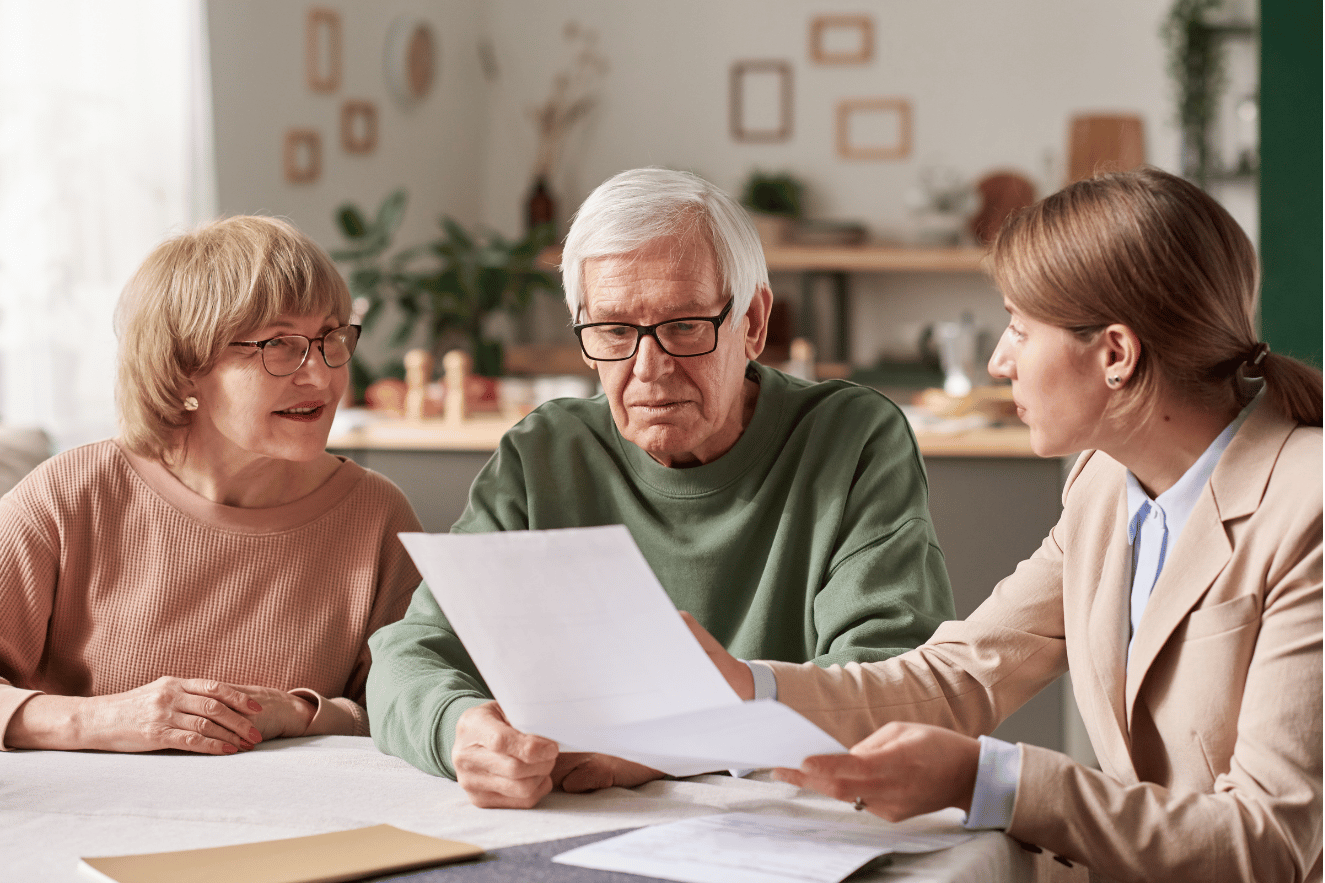

With the help of skilled estate planning attorneys, it’s possible to avoid or minimize the effect of probate on your Florida estate. The experienced estate attorneys at The Law Offices of Travis. R. Walker, P.A., can help create a comprehensive estate plan that prioritizes probate avoidance and gives you the peace of mind you deserve.

How Does Probate Work in Florida?

Probate is the process of authenticating a last will and testament after someone dies and administering their estate.

During the probate process, the court appoints an executor or administrator to act on behalf of the estate. That person will then distribute your assets. If you have debts at death, probate allows creditors to make claims against your estate for payment.

A probate case must be opened to transfer ownership of most assets owned solely by you at your death. Probate cases are filed in the Florida county in which you lived at the time of your death. If you have a valid will, the assets will be distributed according to the instructions provided in that document. If you do not have a valid will, the assets will pass under Florida’s intestate succession laws, which may not reflect your preferences.

Florida law does not require all of a decedent’s assets to go through probate. The ownership of certain beneficiary-designated accounts, such as jointly held accounts and payable-on-death accounts, will transfer automatically outside of probate.

The Law Offices of Travis R. Walker, P.A., deeply understand Florida’s estate laws and can help you create an estate plan to avoid probate in Florida.

How To Avoid Probate in Florida?

Probate can be time-consuming, particularly if illiquid assets are involved, and delay the actual transfer of assets to a beneficiary. Also, since it is a legal process, it involves court filings that become part of the public record and do not remain private.

Finally, while the court costs are not particularly high, the attorney and executor can add up quickly if the case involves complex issues and court proceedings.

A well-thought-out estate plan can preserve your ownership rights over your assets during your lifetime and distribute property to successor owners outside of probate upon your death.

In Florida, there are several ways to structure ownership of financial accounts and real estate holdings to avoid the time and expense of probate. Florida law permits certain ownership structures that transfer assets automatically upon death. These include living trusts, joint tenancy with survivorship rights, payable-on-death accounts, and enhanced life estate “Lady Bird” deeds.

Living Trust

A living trust—also known as a revocable trust—lets you transfer ownership of assets to a new entity while retaining control over the assets. A trust created in Florida is presumed revocable unless the terms of the trust expressly state it is irrevocable.

The most common way to establish a trust is by drafting and signing a trust agreement. This document designates a trustee to manage and oversee the property within the trust and ensure the intent of the trust is carried out. You may designate someone to serve as trustee, or you may act as trustee so long as you remain mentally competent.

The trust agreement also provides instructions for distributing your assets upon your death by naming beneficiaries. As you are no longer the owner of any assets in the trust, they will pass to your designated beneficiaries outside of probate.

Florida law also permits the creation of an oral trust, meaning you can establish a trust by spoken word rather than written agreement. The terms of an oral trust must be established by clear and convincing evidence.

Once you create a trust, you must fund it. Funding a trust is the process of transferring ownership of your assets to the trust. Financial accounts must be changed to reflect the trust as owner, and real estate must be re-deeded to the trust.

You may amend or revoke a living trust at any point during your lifetime. You also retain full control over financial accounts and real estate included in the living trust. You have the power to direct the investment or withdrawal of funds from financial accounts and to sell or otherwise encumber real estate included in the trust. Examples of encumbrances include mortgages and liens, easements, mineral rights, or other restrictions.

Neither a revocable nor irrevocable trust will shield your assets from any creditors’ claims that accrue during your lifetime.

Joint Tenancy With Survivorship Rights

Joint tenancy refers to an ownership interest shared by you and at least one other individual, in which your interest in the property passes automatically to the surviving owners upon your death. This type of automatic transfer occurs outside of probate.

Payable-on-Death Accounts

A payable-on-death or transfer-on-death account is a type of financial account in which you designate a beneficiary or beneficiaries to whom ownership of the account and its funds will transfer automatically upon your death.

Payable-on-death accounts avoid probate due to the automatic nature of the ownership transfer.

Lady Bird Deeds

An enhanced life estate deed, also called a Florida “Lady Bird” Deed, transfers the ownership of real estate while allowing you to retain the right to use and enjoy it during your lifetime. Upon your death, the ownership of the property automatically transfers outside of probate to your remainder beneficiaries.

Under a Lady Bird Deed, you may sell the real estate without the remainder beneficiaries’ consent. You may also attach other restrictions on the property, such as mortgages, liens, easements, and mineral rights agreements.

The attorneys at The Law Offices of Travis R. Walker, P.A., understand that your estate represents many years of hard work. You deserve the peace of mind that comes with knowing this work is protected, and your beneficiaries are cared for. Let our team of dedicated estate planning attorneys help you design an estate plan that avoids probate in Florida.

What Is the Role of a Will in Probate?

During probate, your will provides a set of instructions for the court overseeing your estate’s administration. Your will names an executor—known as a personal representative in Florida—to administer your estate and designates the beneficiaries to whom the Florida probate court should transfer your assets.

Additionally, a will may include your funeral and burial instructions and any charitable donations to be made from your estate.

If a named beneficiary predeceases you, any assets you intend to pass to that individual may be distributed according to Florida intestacy laws. You can avoid this scenario by naming successor beneficiaries in your will.

A valid will is an essential component of any estate plan as it prevents distribution via intestate succession of any assets remaining in your sole possession at the time of your death.

The Role of The Law Offices of Travis R. Walker in Probate Law Cases

The dedicated estate planning attorneys at The Law Offices of Travis R. Walker, P.A., can work with you to create a comprehensive estate plan that maximizes probate avoidance in Florida.

Our skilled professionals can walk you through the many estate planning options available and ensure your documents are properly drafted and executed in compliance with Florida law. We will also stay in touch after your documents are finalized to ensure they remain current with changes in your life and state or federal laws.

The dedicated estate planning attorneys at The Law Offices of Travis R. Walker, P.A., know the complexities of probate law in Florida and have extensive experience helping clients structure their assets to maximize Florida probate avoidance.

Whether you need to create a new estate plan or update your existing documents, our experienced team of professionals can help design a plan to safeguard your future. Contact us at (772) 773-1269 to schedule a consultation.